FACT SHEET

HEALTH SERVICES FUNDING - PREAMBLE

INTRODUCTION TO A FACT SHEET SERIES

There is a growing concern about the future of health services on Saturna, and in particular about the Medical Clinic and the funding that supports it. The Saturna community needs to address this issue so that we can proceed into the future assured that our Medical Clinic will be there when we need it.

A group of individuals and representatives of island organizations came together in November 2016 over a collective concern about the sustainability of funding for the Medical Clinic. The group, which calls itself the Saturna Sustainable Health Funding Committee, began exploring ways to ensure more stable funding for health service delivery on Saturna well into the future.

As context for its work, the group reviewed the array of health and well-being services offered on Saturna, with a focus on those available through the Medical Clinic. The out-of-clinic services, which complement and augment those offered from the Medical Clinic itself, range from Better at Home (a support program for seniors) and public access defibrillators to an annual flu clinic, and Saturna Island Rescue, which provides 24/7 emergency response.

After considerable research and discussion, the Committee is in a position to commence a discussion on the future of health services on Saturna with island residents. And so, to kick-start the conversation, the Committee has developed a series of Fact Sheets to share the information it has gathered and the preliminary conclusions it has reached with the broader Saturna community. The intent is to provide Saturna residents with baseline knowledge, making future consultation more focused and productive. The Fact Sheet series, thus far, includes:

Fact Sheet #1: About the Saturna Medical Clinic Fact Sheet #2: The Need to Sustain Funding for the Medical Clinic Fact Sheet #3: Options to Sustain Medical Clinic Funding Fact Sheet #4: Health Services on Other Gulf Islands

This series of Fact Sheets will be posted on various island websites and distributed at island events such as Saturday markets and Wednesday recycling. Committee members will be present to hear your views and your questions. Collect all the Fact Sheets and have the full story

Saturna Sustainable Health Funding Committee July 2017

SATU RNA

HEALTH SERVICES FUNDING - #1

FACT SHEET #1: ABOUT THE SATURNA MEDICAL CLINIC

A. Services Offered: • one day per week a General Practitioner (MD) - 4.5 hrs. • one day per week a Nurse Practitioner (NP) - 4.5 hrs. - twice monthly a counsellor and a home care nurse • medical equipment loan cupboard • referrals management • co-ordination of a prescription pick-up service • issuance of TAP travel passes to get to off-island tests or referrals • hearing clinic.

B. Clinic Use: 900 appointments annually, plus occasional use by Saturna Island Rescue (the volunteer ambulance service).

C. Benefits Provided:

1. Reduces the number of trips off island for medical appointments, making island living easier for those having difficulty getting off island, including working people, young families and the elderly.

2. Contributes to the vitality and attractiveness of our community by providing services, island employment, and local control. D. Clinic Management and Cost The Saturna Medical Clinic has been managed and operated for many years by the Saturna Community Club, through its volunteer Health Services Committee.

With no resident medical practice on Saturna Island, the Island Health Authority (IHA) pays a day fee and travel costs to the MD, pays the Nurse Practitioner who comes from away, and provides drugs and some medical equipment to the clinic.

IHA also provides, through the Community Club, a part of the salary for a Medical Office Assistant (MOA) who is employed by the Community Club to assist the visiting practitioners, and a 4 hours per month salary for medical supply restocking labour. The Community Club's total annual budget for clinic operations, including the total MOA livable wage salary for health practitioner days and restocking work, non-medical supplies, and cleaning and utilities has been about $23,600 for the past couple of years.

Saturna Sustainable Health Funding Committee July 2017

HEALTH SERVICES FUNDING - #2]

FACT SHEET #2: THE NEED TO SUSTAIN FUNDING FOR THE MEDICAL CLINIC

For decades, the Saturna Community Club has managed the Medical Clinic on an all-volunteer basis, through its Health Services Committee. Over the years, the amount of funding required to maintain the clinic has been growing. Last year's operating budget (not including Medical Doctor and Nurse Practitioner contract fees, drugs or medical equipment, provided by IHA) was $23,600.

A. Current Sources of Support for the Clinic: • Island Health Authority: MD and NP fees, medical supplies, and for clinic operation, partial funding of the Medical Office Assistant, and funding for restocking labour. • Rental Income from other health care professionals is minimal (currently a massage therapist.) • Clinic Patient Fees (for services not covered by MSP) are minimal, and vary from year to year. • Donations have primarily been from the Annual Garage Sale conducted by the Saturna Recycling Centre, and gifted to the Medical Clinic. After 2019, when recycling's confirmed funding ends, the Recycling Centre may need these funds. • The Saturna Community Club has always covered the annual shortfall, and provides the volunteer labour to manage the clinic. Should alternative funding for the Medical Clinic be secured, the Community Club will continue to provide support for health services on Saturna Island.

B. The Current Situation: The Community Club's only source of funds is the annual Saturna Lamb BBQ on Canada Day. These funds must maintain and insure the Community Hall and Recycling Centre, as well as keep the Medical Clinic clean and supplied, utilities paid, and the Medical Office Assistant's wages topped up to a liveable level.

C. Our Concerns: • The BBQ's viability is uncertain as volunteers age and burn out (average age on Saturna is 60). • The BBQ's revenue is inconsistent, and could be greatly curtailed by bad weather and other factors beyond the island's control.

D. Opportunities: • Secure, stable funding will allow the creation of a paid part-time Health Co-ordinator position and a bookkeeper which would take stress off aging clinic volunteers. • Alternative funding for the Medical Clinic would free up BBQ revenue for supplementary health and wellness services not currently possible, but available on other islands.

HEALTH SERVICES FUNDING - #3

FACT SHEET #3: OPTIONS TO SUSTAIN MEDICAL CLINIC FUNDING

There are several scenarios currently under review to address the sustainability of Medical Clinic funding. There is no necessity to select only one of the avenues - we may consider the use of one or more of the options in concert. The first task was to review, in detail, the current budget, both the expenditures and the sources of income. The second task was to look at our needs for the future of the operation and to propose an expenditure budget that meets those needs. This may include, but is not limited to, the addition of a part time clinic manager, bookkeeper and/or other new services. These reviews give us the gross amount of income necessary, on an annual basis, to provide Saturna residents, weekenders and visitors with adequate service.

The next step was to take a serious look at the current sources of income and determine the stability and level of risk for each into the future. This allows us to fully understand the gap between proposed expenditures and secure revenue available. While the committee was dealing with the gap issue, the possibility of securing or increasing the current cash inputs was studied. Options discussed include:

• long-term secure income from the Saturna Community Club • increased clinic rentals to other health professionals • donations from service groups or island organizations • annual revenue from the Saturnina Foundation or other long-term endowment fund • a tax levy • the status quo.

After intense study we believe that we may need to look at a portion of the financial needs being met by a property tax that could be put in place with a referendum during the 2018 municipal elections. This would be the foundation for stable funding. The CRD would oversee the referendum, giving every property owner on our island a voice on proceeding with a tax levy for the clinic. A simple majority vote would decide the issue. The exact amount of annual tax on your property has not as yet been calculated, but would likely fall within the range of $7 to $15 per $100,000 of value for a residential property.

It is time for discussion and expanded idea gathering. Your input is requested.

HEALTH SERVICES FUNDING - #4

FACT SHEET #4 - HEALTH SERVICES ON OTHER GULF ISLANDS

No two places are the same in providing health services. Each island has varied funding: doctors' fees, taxes, rent, donations and volunteer labour. Differences in size, location, population and services offered are key factors. The Rural Health Services Framework document created by Island Health (IHA) classifies Saturna as an "Isolated Island". The classification of each place sets a framework, but doesn't determine what services can or could be provided. It is however useful to compare and contrast Saturna to other similar Gulf Islands or "isolated islands".

Mayne Island has a population three times larger with more frequent ferry service, yet shares characteristics with Saturna. The Mayne Island Health Centre Association (www.mayneislandhealth.ca, a BC non-profit society with a board of directors, operates the health centre. It is funded from property taxes (collected through the Mayne Island Improvement District), donations, rent and events. Services available include; • Resident Physician 3 days per week (fee for service and IHA 'top-up') • Nurse Practitioner 3 days per week (IHA) • Massage, Chiropractic (private) • Home and Community Support (IHA) • Mental Health and Substance Abuse (IHA) • Vision care (Private) Galiano Island has both a similar population and ferry frequency as Mayne. Galiano Health Care Society (GHCS), a registered BC non-profit and a federal charity, has provided health services on Galiano for the past 25 years. It operates the GHC Centre through a board of directors and an executive director and staff. Their total annual budget is approximately $ 140,000, funded by events, donations, grants, rentals and an annual property tax levy (since 2014). In 2014, the GHCS applied to the CRD to place $86,500 per year on the property tax rolls (of which the CRD receives a $1,550 administration fee). This passed with 90% support. Services at the Health Centre include: • Full time Doctor, Nurse Practitioner, and Home and Community Care Nurse (IHA) • Once a week dentist • Better at Home, Ageing in Place, Education • Physiotherapy, Podiatry, Massage, Laboratory With a population of 2,300, and very frequent and convenient ferry service, the Pender Islands have resident physician(s) who operate the clinic on a fee-for-service basis typical of larger communities, avoiding the necessity of community funding. They also offer a wider range of services that can be supported by a large population.

Hornby Island is quite isolated, with a population of about 1,000 residents and infrequent ferry service. It operates in alliance with adjacent Denman Island (population of 1,100) and the Comox Valley, in one large and well-funded entity (from taxes, donations, doctor's fees, fund raising, etc.) with several clinics. It has resident doctors, paid administrators and a wide range of services. Unusually, they charge a membership fee of $5.00 per year.

Saturna Sustainable Health Funding Committee

HEALTH SERVICES FUNDING-#5

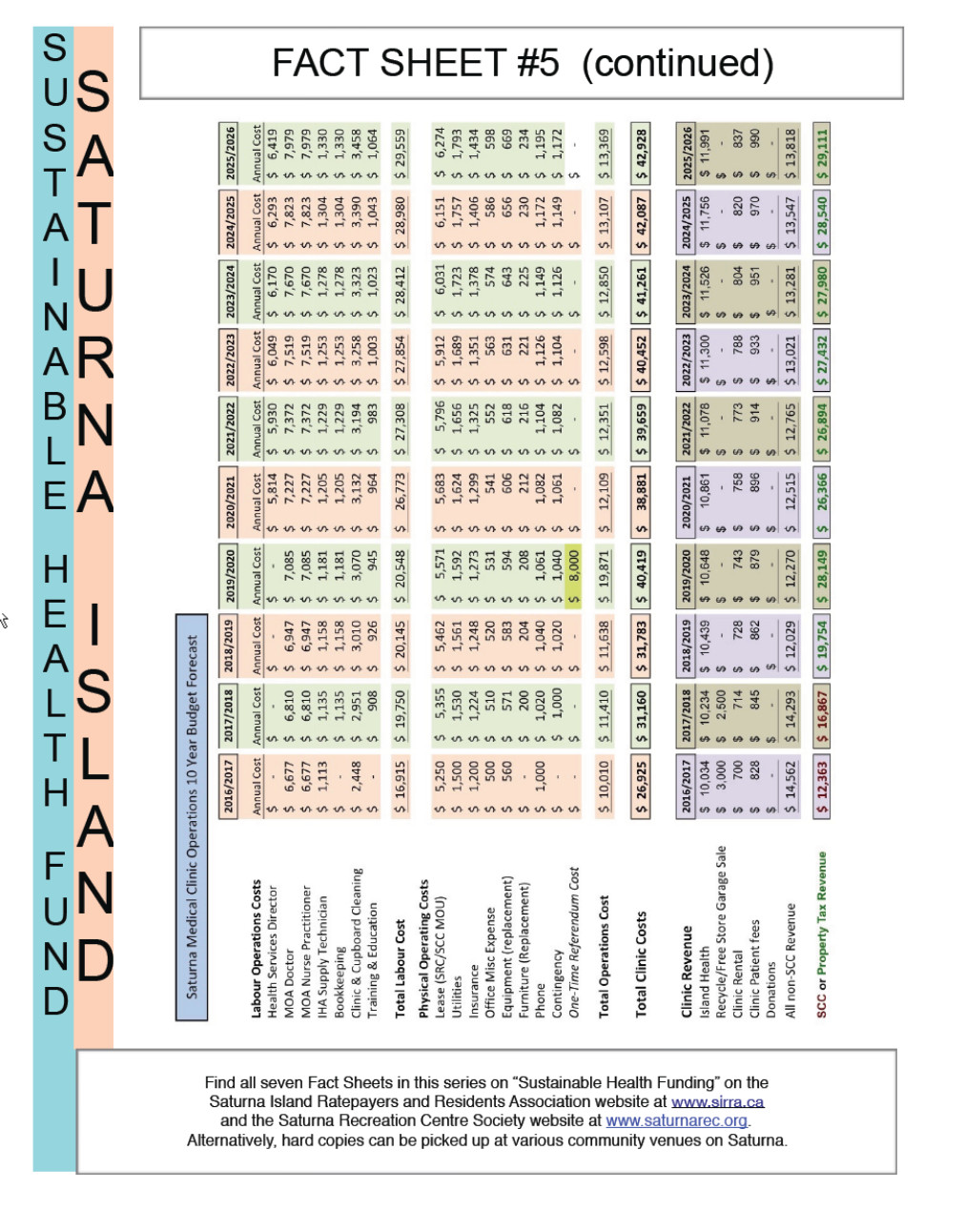

FACT SHEET #5: MEDICAL CLINIC OPERATIONS BUDGET AND FORECAST

The detailed budget forecast for the Saturna Medical Clinic is found on the following page. These explanatory notes inform as to why there are budget variances over the next few years.

Most Recent Budget (2016/17)

Costs: The most recent budget shows clinic operating costs of roughly $27,0011 However, the clinic operation is managed though volunteer efforts of the Saturna Community Club (SCC). The SCC also performs a bookkeeping service for the medical clinic, again on a volunteer basis. These two services have an approximate annual value of $7,000, for a net operating cost of $34,000.

Revenues: Island Health UM provides $10,000 towards operations. Roughly $3,000 comes from donations, most of which is from the Recycle/Free Store garage sale. Clinic rental (masseuse) & patient fees account for $1,500. The remaining funds (and in-kind volunteer labour) of nearly $20,000 are provided by SCC.

Budget Forecast (2017/18 through 2025/2026)

There are three major shifts in the budget forecast.

The first of these may not materialize, depending on whether a referendum to place Medical Clinic operations on the property tax rolls is successful. If the referendum passes, a one time cost of roughly $8,000 would result in 2019/2020. The second is the presumed loss of Recycle/Free Store garage sale funding. These funds may be required for recycle centre operations, in that special CRD recycle funding is scheduled to expire in 2019, with no indication from Recycle BC that replacement funds will be available.

The third shift is related to the capacity of the SCC to continue to provide volunteer bookkeeping and operations management. This $7,000 in-kind expense will shift to being funded, similar to other organizations on Saturn&

Finally, the budget forecast suggests that SCC or property taxes will fund the community's portion of Medical Clinic operations. More likely and similar to other island medical operations, property taxes will fund base-load operations, with SCC funding from its surplus, for a combined effort at providing Saturna's Medical Clinic.

1. See Column four (2019/20) on following page for the one time referendum cost.

FACT SHEET #6: REFERENDUM FACTS

Context

•At its Quarterly Meeting in December 2017, the Saturna Community Club (SCC)

approved a motion to submit an application to the Capital Regional District (CRD) for a

referendum to fund the community’s portion of Saturna Medical Clinic expenses from

property taxes. SCC would be the agency designated to receive and disburse the tax

funds until such time as a new society may be required.

What Is The Proposed Referendum?

•A referendum is a vote administered by the CRD to determine whether Saturna

property owners will pay additional property tax to provide secure and predictable

funding for the Saturna Medical Clinic.

Who Can Vote?

•Eligible voters are Saturna residents and non-resident property owners who:

•Are Canadian citizens

•Have been residents of British Columbia for at least 6 months

•Are 18 years of age or older on the day of the vote

•Have lived on or owned property on Saturna for at least 30 days before the

referendum.

What is the Process for a Referendum?

•The proposal is to hold the referendum in conjunction with the October 2018 municipal

elections as the estimated cost of $8,000 would be less than for a stand-alone

referendum at some other time.

•50%+1 of those who vote is required for the referendum to pass.

•There is no minimum percentage of island residents and property owners who must

vote in the referendum to render its outcome valid.

•CRD’s bylaw has provisions for mail-in balloting.

•If the referendum succeeded, this cost would be borne by Saturna taxpayers: the tax

requisition for 2019 would include the Medical Clinic budget for that year, the cost of the

referendum and any other costs incurred by the CRD. Thus, property taxes in the first

year would be higher than in subsequent years in order to pay off the referendum.

•The tax levy would be divided among Saturna taxpayers on the basis of assessed

values, and not on the basis of the regressive parcel tax. This means property owners

would pay based on property assessed values rather than all paying the same amount,

regardless of the value or size of their property. 2

Saturna Sustainable Health Funding Committee

February 2018

SATURNA

FACT SHEET #6 (continued)

•If the referendum failed, the CRD would pay for it.

•Tax funds from a successful referendum would flow to the SCC in August 2019,

following payment of 2019 property tax bills.

•At the CRD level, planning for a referendum usually takes about 6 months, with the

catalyst being an application from Saturna. The SCC intends to submit its application in

early spring 2018. This would be followed by a CRD staff report and bylaw to the

Electoral Services Committee, and then the CRD Board.

•The referendum would be managed by CRD staff, who would work with the SCC on all

information that goes to the public. This would include a description of what the tax

funds will be used for, the anticipated annual cost to the taxpayers, the maximum tax

requisition for the service, the geographic area of the service, and any other information

that is necessary to enable the voters to make an informed decision.

How Much Additional Property Tax Will I Have to Pay if the Referendum Passes?

•Assuming an annual budget of about $26,000 to cover the community’s portion of

Medical Clinic expenses through taxation, you can determine a very close estimate of

your tax amount by following the steps outlined below:

•Review your 2017 property bill and find the amount you paid towards financing the

Saturna Island Fire Protection Society’s (SIFPS) annual $150,000 budget. Since the

$26,000 for the Medical Clinic is about 17% of the SIFPS’s annual budget, your tax

cost will be about 17% of what you paid for SIFPS.

•In Year One only, we would have to raise about $8,000 as a onetime cost for

conducting the referendum and for the collection costs. Hence, in Year One, with

$28,000 required from tax funds, you would be required to pay about 19% of the

SIFPS tax amount. [see budget table on Fact Sheet 5]

•We are forecasting that the Medical Clinic budget would increase at a rate of 1 to 2%

per year.

•Prior to the referendum, the SCC will present a detailed and updated budget for the

Medical Clinic and a recalculation of the process to review your cost. This would be

based on the 2018 assessed values and the then-current SIFPS budget so that you

gain a more accurate idea of the financial impact on you.

Questions or comments, email:

sustainablehealthfunding@gmail.com.

Find all seven Fact Sheets in this series on “Sustainable Health Funding” on the

Saturna Island Ratepayers and Residents Association website at www.sirra.ca

and the Saturna Recreation Centre Society website at www.saturnarec.org.

Alternatively, hard copies can be picked up at various community venues around Saturna.

FACT SHEET #7: OTHER QUESTIONS AND ANSWERS

PERTAINING TO THE PROPOSED TAX LEVY REFERENDUM

Q#1: If we changed from the Saturna Community Club (SCC) to a different organization as the

operator of the Medical Clinic at some time in the future, does the referendum become invalid,

necessitating another to approve dispersal of the tax funds to a new organization?

A#1: No, Capital Regional District (CRD) staff have indicated we could make such a change

without having to have another referendum.

Q#2: If we are going to use tax dollars to cover the community’s portion of Medical Clinic

expenses, what say will we have in the quality and adequacy of the medical services that are

supplied?

A#2: About the same as we have now. The budget that tax levy funds would cover is the

community’s portion of Medical Clinic operations - rent, utilities, office equipment and supplies,

and a portion of the Medical Office Assistant’s salary. The doctor and nurse practitioners are

paid for by Island Health. Therefore, voting for a tax levy will not change how the doctor and

nurse practitioners are deployed We also don’t pay the massage therapist and other private

practitioners operating out of the clinic. We can advocate for more doctor days from Island

Health, and attempt to increase wellness services by publicizing that we have a clinic available

to practice out of. But we are not and will not be in a financial position to pay a practitioner to

come to Saturna, nor is it easy to attract roving practitioners with our small population.

Moreover, some practitioners, such as a dental hygienist, would need to bring his/her own

equipment and supplies. Of note is that Island Health representatives recently assured Saturna’s

Health Services Committee they will try to be more consultative when discussing and making

decisions about health care on Saturna.

Q#3: Has any thought been given to trying to increase the quantity of services (extended hours,

additional services) with a tax-based budget?

A#3: We have given that question some thought but have decided to take a minimalist

approach and try to stabilize the funding for what we have right now, increase our medical

service spending flexibility, and take the pressure off the Lamb BBQ to reap a required level of

return. So you would not see, at least in the first few years of a tax-funded Medical Clinic, any

expansion of services. There could possibly be creative ways to add other services in the future.

Saturna Sustainable Health Funding Committee

February 2018

SATURNA

Q#4: If we vote for a tax levy, how do we know that Island Health will not reduce its funding for

the Medical Clinic in response?

A#4: In an October 2017 meeting with senior Island Health administrators, Health Services

Committee members were assured that government funding would not be reduced in response

to fund-raising on the part of the Saturna community. Moreover, Island Health has not

decreased funding on Galiano and other locations after additional funding sources were

identified.

• If the referendum failed, the CRD would pay for it.

• Tax funds from a successful referendum would flow to the SCC in August 2019,

following payment of 2019 property tax bills.

• At the CRD level, planning for a referendum usually takes about 6 months, with the

catalyst being an application from Saturna. The SCC intends to submit its application in

early spring 2018. This would be followed by a CRD staff report and bylaw to the

Electoral Services Committee, and then the CRD Board.

• The referendum would be managed by CRD staff, who would work with the SCC on all

information that goes to the public. This would include a description of what the tax

funds will be used for, the anticipated annual cost to the taxpayers, the maximum tax

requisition for the service, the geographic area of the service, and any other information

that is necessary to enable the voters to make an informed decision.

How Much Additional Property Tax Will I Have to Pay if the Referendum Passes?

• Assuming an annual budget of about $26,000 to cover the community’s portion of

Medical Clinic expenses through taxation, you can determine a very close estimate of

your tax amount by following the steps outlined below:

• Review your 2017 property bill and find the amount you paid towards financing the

Saturna Island Fire Protection Society’s (SIFPS) annual $150,000 budget. Since the

$26,000 for the Medical Clinic is about 17% of the SIFPS’s annual budget, your tax

cost will be about 17% of what you paid for SIFPS.

• In Year One only, we would have to raise about $8,000 as a onetime cost for

conducting the referendum and for the collection costs. Hence, in Year One, with

$28,000 required from tax funds, you would be required to pay about 19% of the

SIFPS tax amount. [see budget table on Fact Sheet 5]

• We are forecasting that the Medical Clinic budget would increase at a rate of 1 to 2%

per year.

• Prior to the referendum, the SCC will present a detailed and updated budget for the

Medical Clinic and a recalculation of the process to review your cost. This would be

based on the 2018 assessed values and the then-current SIFPS budget so that you

gain a more accurate idea of the financial impact on you.