Property Taxes Part I - Introduction - 2014

aturna Island Property Owners Association

1

Property

Taxes

101:

Part

I

Introduction

One of SIPOA’s priorities coming out of our members’ survey last fall was to take a

close look at our property taxes – what they are and what we get for them. We will

prepare a series on property taxes, digging deeper into the details as we go.

This is the first installment, which provides an overview of how our property taxes have

changed over the past 10 years.

What

Have

Your

Property

Taxes

Done

Lately?

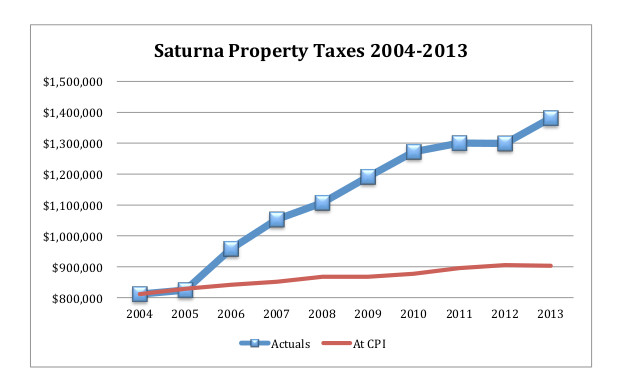

Since 2004, total property taxes levied on Saturna have increased from $811,000 to

$1,381,000, an increase of 70%. Or, put another way, our property taxes have

increased 6 times the rate of inflation.

Why

The

Rampant

Growth?

To answer this question, we started by grouping the various tax levies into three levels

of government based on who requests the tax monies (see Appendix A for “How your

property taxes are calculated”).

Actuals

At

CPI

aturna Island Property Owners Association

2

• Provincial: Levies requested by the Province for province wide services

• Regional: Levies requested by the CRD and the Islands Trust for services in

CRD’s Area G and the Islands Trust area

• Local: Levies requested and controlled by local authorities on Saturna

In 2013, the $1.38 million of property taxes levied on Saturna was made up of:

• 56% or $773,000 of Provincially controlled taxes

• 27% or $373,000 of Regionally controlled taxes

• 17% or $235,000 of Locally controlled taxes

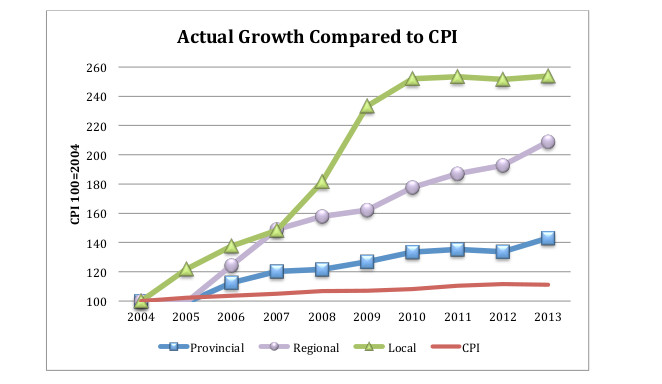

The graph below shows how these three categories of taxes have grown compared to

CPI over the past ten years. It shows that locally controlled taxes have increased the

most and have more than doubled since 2004. Regionally controlled taxes have

doubled in the same period while provincially controlled taxes have “only” increased

30% faster than CPI.

Conclusion

All levels of property taxes have increased above inflation, some because of increased

population (provincial taxes) and others because of improved services. It is clear from

the graph above that the largest increases stem from regional and local taxes and in the

following installments of this Property Tax series we will explore each one in detail to

examine why the increase and what services we, as property owners on Saturna, get.

Appendix

A

–

Fact

Sheet

2013

Saturna

Property

Taxes

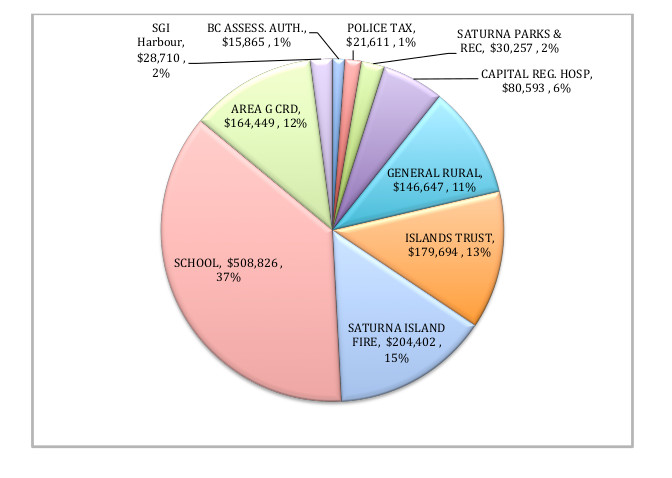

In 2013 $1,381,108 was levied in property taxes on Saturna. The graph below shows

that amount broken down by taxing authority.

Description

of

Tax

Levies

Provincially Set Levies

• School Tax: Levied by the Province for education services and school facilities.

• General Rural Tax: Levied by the Province to build and maintain rural roads.

• Police Tax: Levied by the Province to pay for police services.

• BC Assessment Authority: Levied by the Province to pay for property

assessments. This Crown Corporation assesses the value of all properties in the

Province of BC. Most property taxes are based on the assessed value of your

property. The Assessment Authority is responsible for hearing appeals from

BC

4

property owners with respect to the value attached to their property – their

website is www.bcassessment.bc.ca

• Municipal Financing Authority: Levied by the Province to pay for this special

agency, which borrows on behalf of all local governments in BC.

• CRD Hospital Tax: Levied by the Province for funding up to 40% of the cost of

capital equipment and projects at hospitals within the CRD. The Vancouver

Island Health Authority (VIHA) is responsible for delivering health care services

on Vancouver Island and advises the Regional District on their capital

requirements. VIHA pools both Provincial and Regional District funding with

other sources such as foundations etc. to maintain, improve and build health

care facilities.

Regionally Set Levies

• CRD Area G: Levied by CRD for “general services” such as water, recycling and

library.

• Islands Trust: Levied by the Islands Trust for local land use planning services.

• SGI Harbour Commission: A parcel tax (not based on property assessment)

levied by CRD to manage docks in the SGI.

Locally Set Levies

• Saturna Fire: The tax rate is set by referendum on Saturna, taxes collected by

the CRD and given to Saturna Island Fire Protection Society to manage fire

protection on the island.

• Saturna Parks and Rec: Based on the annual budget determined by the

Saturna Parks & Rec Commission for managing CRD parks and recreational

activities on Saturna.

How

your

property

taxes

are

calculated

The Surveyor of Taxes collects property taxes from properties outside of municipal

boundaries, such as from properties in the Capital Regional District. Each year the

amount of property taxes is determined as follows:

1. The taxing authority (CRD, Islands Trust, the Province etc.) approves a budget

for the coming year and this becomes the “tax requisition”.

2. The authority sends its “tax requisition” to the Surveyor of Taxes.

3. The BC Assessment Authority provides assessment information to the Surveyor

of Taxes.

4. The Surveyor of Taxes divides the property values attached to each service into

the requested “tax requisition” which results in the tax rate (also called mill rate)

on your property tax notice.