BC Assessment Response- January 28, 2015

Dear Ms. Hage and Mr. Dow,

Thank you for your inquiry and the opportunity to respond to your questions. I have

provided below information that I trust will assist with understanding 2015 property

assessments on Saturna and Mayne Islands.

BC Assessment produces annual market value assessments for approximately

2,000,000 properties in the province of BC including approximately 146,000 within the

Capital Region. There are 680 properties on Saturna Island and 1,392 properties on .

Mayne Island.

For residential property assessments, BC Assessment (BCA) employs a sale

comparison approach in conjunction with a market adjusted cost model. That is to say,

we collect and maintain attributes on each property which are recognized as market

drivers and are aligned with market preferences. Each year we conduct analyses

through sale comparison to trend our assessments to market value. Due to the volume

of assessments that must be produced each year, we employ the use of mass appraisal

techniques and models in our processes.

Econometric Model

The Sales Comparison Approach models the behavior of the market by comparing the

properties that are being appraised with similar properties that have recently sold. The

economic principles of supply and demand provide the framework for understanding

how the market functions. Supply is influenced by current inventories and demand is

influenced by general economics such as population levels, mortgage rates, income

levels, local services, personal housing preferences and the cost of substitutes. The

principle of substitution ensures that prudent purchasers will not pay more than a

comparable property with similar utility and implies that the market will recognize

differences in utility between a property and its best alternative by a difference in price.

The Sales Comparison Approach estimates the market value of a property by adjusting

the sale prices of comparable properties for differences between the sold properly and

the property being assessed. Mass appraisal builds on the same basic principles but

involves the appraisal of many properties as of a specific date. Mass appraisal

techniques employ equations, tables and rate schedules, collectively called models.

These principles are the basis for the creation of our market value assessment roll.

Accurate land values are central to an effective assessment system or model. It is the

first stage in our residential mass assessment model and land valuation is foundational

to achieving the total assessed value where an improvement exists on a property. The

improvement value constitutes the residual value linking the sale price and the land

valuation. In other words, sale price minus improvement residual equals land value.

In mass appraisal or assessment, these processes translate into many assessments.

Through annual roll quality enhancement and uniformity analysis we routinely audit and

verify our property information and our mass appraisal models.

Mass Appraisal Model is the process of adjusting mass appraisal formulas,

tables and rate schedules to the current market. For land valuation, these tables contain

land values per unit (typically acres for the Gulf Islands), along with adjustments for size

and other locational features (namely topography, view, and directional orientation). In

this past year, our office conducted a recalibration of land size adjustment factors

through a loglinear regression using sales data. This review is a necessary process to

make certain the land dimension factors exhibit a correlation to the market data

analysed annually ensuring acceptable uniformity in the assessment roll against

international standards.

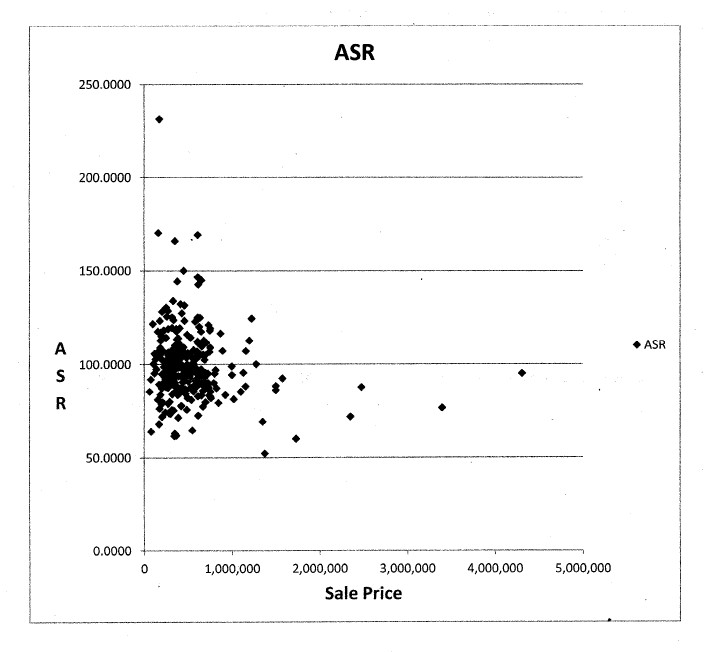

2014 Acreage Sales — Gulf Islands

The graph below includes all single family residential, acreage and vacant residential

sales for the Gulf Islands. The data shows a normal distribution based on international

ratio standards. Internationally recognized measures of quality are the assessment to

sale ratio (ASR) and the coefficient of dispersion (COD). The median ASR for the Gulf

Islands is 97.63. The median is midpoint of the sales population with half of the sales

being above the median and half of the sales being below the median. For residential

properties, BCA's standard for the ASR is between 97 and 100 exceeding the

international standard of between 90 and 110. The COD for the Gulf Islands is 13.25.

The COD is the most utilized measure of uniformity in ratio studies and is based on the

average absolute deviation from the median ASR expressed as a percentage. For

residential properties, BCA's standard for the COD is < 15. A COD of 15 or less for a

heterogeneous region is associated with good uniformity.

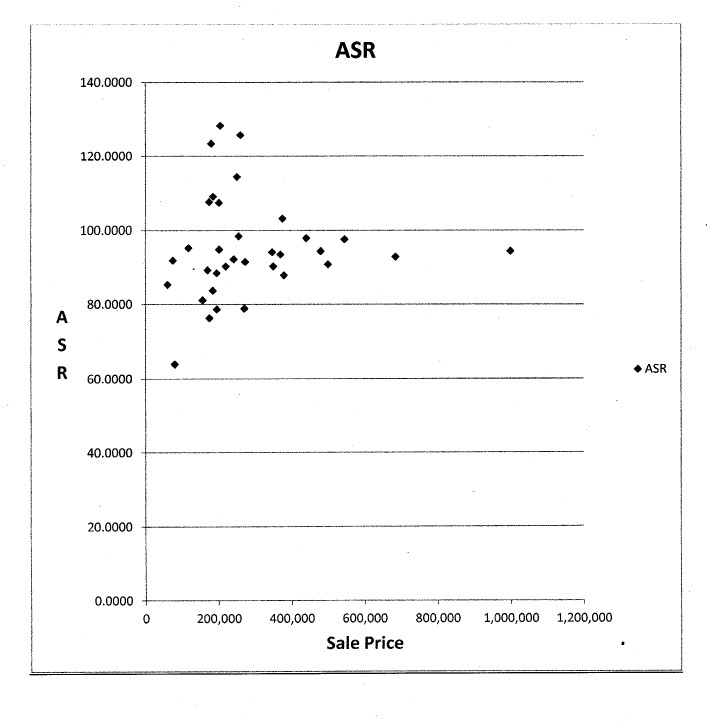

2014 Acreage Sales - Mayne/Saturna

The graph below includes sales from Mayne and Saturna Islands only. The distribution

is normal but the median ASR is 93.18 indicating the assessments are slightly below the

standard. This is primarily due to the higher valued properties all trending at or below

100 in the distribution. The COD is 10.29 which again is associated with good

uniformity.

Sales Volumes

The tables below summarize volumes of sales for 2011 through 2014. As can be seen,

the overall sale volume for 2014 is at or above the previous years indicating there is no

observable impairment on demand levels in the market.

Sales Volumes - Gulf Islands

Single Family Residential Acreage Vacant Residential Total

2014 204 89 53 346

2013 159 59 42 260

2012 136 66 35 237

2011 138 43 37 218

Sales Volumes - Mayne Island

Single Family Residential Acreage Vacant Residential Total

2014 24 1 6 31

2013 19 2 9 30

2012 16 1 3 20

2011 15 2 6 23

Sales Volumes - Saturna Island

Single Family Residential Acreage Vacant Residential Total

2014 4 2 1 7

2013 3 - 2 5

2012 1 2 1 4

2011 5 - 2 7

Listings

Below is a table of listings for Mayne and Saturna Islands. Of the 15 properties listed

July 2014, 4 are listed below the 2015 Roll value. This is presented to provide a

perspective on listing prices in relation to assessment levels only as a benchmark. The

data below indicates good alignment.

Mayne Island Listings

Listing Listing

Roll # Address MLS # Acres Jan-15 . Jul-14 Assessment

05752050 560 Waugh V1089570 9.9 $249,900 - $237,000

* 05212000 392 Campbell Bay V996316 8.13 $279,000 $279,000 $269,000

05752060 550 Waugh V1089559 48.43 $350,000 - $394,000

05142260 332 Deacon Hill V991312 10.01 $479,000 - $383,900

05046100 640 Purcell V1045486 13.79 $699,500 $699,500 $951,000

05142270 308 Deacon Hill V1078306 10 $898,000 - $647,000

* 05563090 445 Garrick V1032911 28.4 $960,000 $960,000 $335,000

05142430 382 Deacon Hill V884969 10 $1,200,000 $1,200,000 $965,000

** 05207000 378 Campbell Bay V1039717 143.29 $1,799,000 $1,799,000 $220,803

05142160 467 Heck Hill 314330 10.39 $719,000 $719,000 $484,000

05142170 414 Heck Hill 344176 10.01 $997,000 - $691,000

05141000 631 Gallagher Bay 344223 25.24 $1,100,000 - $523,000

** 05202000 540 Fernhill 325511 20.1 $1,180,000 $1,485,000 $679,647

* Vacant

** Farm

Saturna Island Listings

Listing Listing

Roll # Address MLS # Acres Jan-15 Jul-14 Assessment

07068001 652 Tumbo Channel V1097332 8.18 $499,000 $499,000 $500,000

* 07253130 Lot 12 Gaines Rd 335609 13.2 $229,950 $229,950 $270,000.

* Vacant

Resold Properties

There are a total of 44 properties which have sold and resold between January 2010

and January 2015 in the Gulf Islands. Of these, 2 are on Mayne Island and there are no

resold properties on Saturna Island. The 2 resold properties for Mayne Island indicate

there is marginal positive change over this time period.

Market Trend

As detailed earlier, assessments are based on sales transactions which is reported

annually to property owners. For the outer Gulf Islands, many purchasers are off island

which is intrinsic to that market. As a result the real estate market typically exhibits a

lower volume of sale transactions and market changes or corrections tend to be slower

to develop as was witnessed after the 2008 financial market difficulties. We have

however noted a deflationary trend in the Magic Lake properties on Pender Island. This

is believed to be the result of a saturation of small lots which is impacting that market.

Conclusion

A Mass Appraisal Model recalibration occurred in 2014. This was required to address

land valuation for larger properties where a gap existed between sale indications and

the assessments. This has resulted in instances where the assessment trend for

property owners of larger acreage differs from the general trend, It is part of BGA's

normal practice to annually undertake assessment reviews, audits and quality

enhancement initiatives. The actions as a result may cause shifts in values, however it

is the market value as of July 1 that must be estimated in accordance to the

Assessment Act. In December 2014, courtesy notification letters were delivered to

property owners with notable changes on their 2015 Assessments and they were invited

to contact us to obtain further information and rationale for the change.

As can be seen from the data presented here, the assessments for Mayne and Saturna

Islands are within international standards for mass appraisal and exhibit good

uniformity. We are committed to monitoring the real estate market through the analysis

of sales as well as other market influences and report those findings on the assessment

roll each year.

Should your members continue to have concerns with their 2015 property assessments,

they may choose to file a 2015 Notice of Complaint (Appeal). The deadline to file an

Appeal is February 2, 2015. Information on how to file an Appeal is included on the

assessment notice or at www.bcassessment.ca.

I invite you to contact me or meet with me in person to discuss and review this

information in detail.

Sincerely,

Greg Wood

Deputy Assessor, Capital Region

cc: Reuben Danakody

Regional Assessor, Capital Region